Publication of budget implementation data

Treasury informs Eurostat that Spain met the stability target and closed 2023 with a final deficit of 3.64% of GDP

News - 2024.3.27

The Ministry of the Treasury has today published data on its website corresponding to the budget execution of Public Administrations from the close of 2023 and early 2024.

First, the fiscal year 2023 finally closed with a deficit of 3.64% of GDP, including financial aid. This is slightly lower than the 3.66% provisional figure reported last week which has changed slightly after receiving the final national accounts data. Excluding financial aid, the deficit stood at 3.65%. The Ministry of Finance has reported the official closing figure to Eurostat, which is in line with and even better than the 3.9% forecast committed to with the European Commission. This is the fourth consecutive year that Spain has fulfilled its commitments to Brussels.

A deficit reduction that has been based on economic growth, taking into account that Spain grew by 2.5% in 2023, five times more than the average for the eurozone. Also in the dynamism of employment with a record number of Social Security affiliates reaching 21 million employed people, according to data from the Labour Force Survey for the fourth quarter of 2023.

Thus, Spain has demonstrated once again this year that it is possible to reduce the public deficit and strengthen the welfare state by deploying a social shield to combat the effects of the war in Ukraine and protect the country's social majority. In fact, since the outbreak of the pandemic in 2020, Spain has reduced its deficit by more than €60 billion while expanding public services.

A path towards a balanced budget that continues in 2024. In fact, the Ministry of Finance has also published the State deficit data for February this year, which stands at 0.61% of GDP, compared to 0.64% in the same period in 2023. This brings the deficit up to the second month of the year to €9.466 billion.

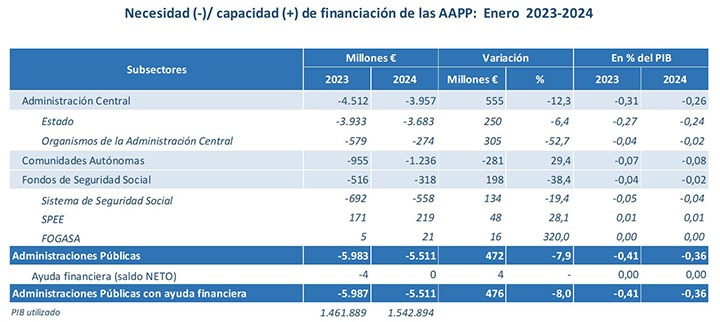

Likewise, the consolidated deficit data of the Central Government, Autonomous Regions and Social Security for January in national accounting terms were also released today, falling to 0.36% of GDP, compared to 0.41% a year ago.

Government deficit (February)

Up to the second month of 2024, the government recorded a deficit of 0.61% of GDP, down from 0.64% in the same period last year. This brings the deficit to €9.466 billion euros.

This development is due to an increase in revenues of 3 % to €30.546 billion, while expenditure rose by 2.5 % to €40.012 billion.

Non-financial resources of the state

Non-financial resources amounted to €30.546 billion, 3% more than in the same period of 2023. Taxes amounted to €25.572 billion, 84% of total resources, and grew 7.5% compared to February 2023.

Taxes on production and imports increased by 3.3%, of which €12.99 billion is VAT revenue, 3.4% higher than in 2023. VAT revenue is up for a number of reasons, including temporary rate reductions that were implemented as a result of price pressures on various essential goods in production and consumption, and which from January 2024 have begin to gradually increase. On the other hand, the tax on non-reusable plastic packaging stood at €81 million, while in 2023, the year in which it came into force, revenue stood at €39 million.

Current taxes on income and wealth amounted to €7.414 billion, 19.7% higher than in the first two months of 2023. Of this amount, €843 million corresponds to the Temporary Levy on Credit Institutions and Financial Credit Establishments. Personal income tax reached €5.336 billion and non-resident income tax revenues increased by 19.1 % to 791 million.

In addition, taxes on capital amounted to 25 million euros and income from social security contributions to 972 million euros.

Property income amounted to €1.033 billion, of which €992 million related to interest, up 55% on the previous year, and €41 million to dividends and other income.

Revenues from the sale of goods and services stood at €339 million. Finally, the rest of the resources stood at 512 million, including investment aid and current international cooperation, among others.

Non-financial employments of the state

The largest item is transfers between public administrations, with a weight of 59.7% of total non-financial uses. Specifically, in the first two months of the year they amounted to €23.906 billion, 2.9% more than the previous year.

On the one hand, the regional administration has received 14.325 billion. Of the total transfers, €13.432 billion correspond to the financing system, of which €13.315 billion are payments on account and the rest correspond to the advance of resources of the financing system.

For its part, the Social Security Funds received €4.215 billion, 26.1% more than in 2023, of which €4.192 billion went to the System and 23 million to the SEPE.

On the other hand, Local Government has received €4.382 billion, which is €752 million more than the previous year. Of the total transfers, €3.616 billion corresponds to their share of state revenue, 0.2% more than in the previous year. The rest of the transfers amounted to €766 million, compared to €20 million in the previous year. This increase derives from the State's financial coverage of the overall negative balance of the final settlement of the 2020 financing system.

Compensation of employees grew by 2.2 % to EUR €3.14 billion. Thus, wage remuneration is up by 2.7% compared to February 2023. Intermediate consumption amounted to €1.078 billion, 4.6% more than in the same period of the previous year.

Accrued interest increased by 24.9% to €4.395 billion, while social benefits other than social transfers rose by 8.3%, mainly due to higher outlays on retirement pensions, which were up by 6.9% to €3.121 billion, among other reasons, because of the 3.8% revaluation of contributory pensions in 2024.

Spending on grants reached €640 million. Production subsidies increased by €57 million, from €46 million in February 2023 to €103 million in February 2024. Of this figure, €81 million is for road transport aid and €15 million for aid to cover the price of diesel consumed by agricultural producers.

For its part, current international cooperation stands at €179 million, of which 43 million corresponds to the contribution to the European Development Fund, while the contribution to the EU from own resources based on VAT and GNI stands at €1.821 billion.

Last, gross fixed capital formation stood at €988 million an increase of 1.6%, while investment aid and other capital transfers together amounted to €183 million.

Joint deficit of the Central Government, the Regional Governments and Social Security Funds (January)

In January 2024, the combined deficit of the Central Administration, the Social Security Funds and the Autonomous Regions stood at €5.511 billion, equivalent to 0.36% of GDP, down from 0.41% in the same period of the previous year.

Central government

The Central Government deficit stood at €3.957 billion euros at the end of January 2024, which equates to 0.26% of GDP. Excluding financial aid, this result is 12.3% lower than in the 2023 period at €4.512 billion.

- The government deficit in January, in terms of GDP, is equivalent to 0.24%, or €3.683 billion.

- Central Government Agencies recorded a deficit of €274 million in January 2024, 52.7% lower than the deficit in 2023.

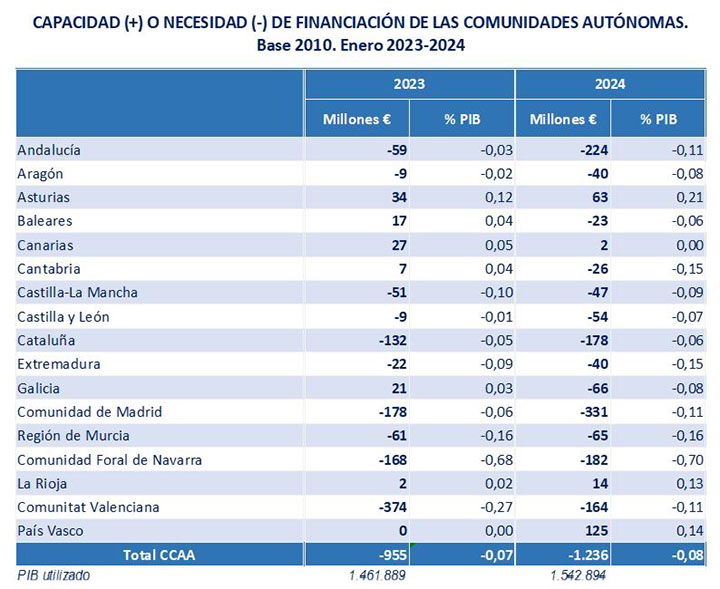

Autonomous regions

Regional administrations recorded a deficit in January 2024 of €1.236 billion, equivalent to 0.08% of GDP, compared to a surplus of 0.07% in the same period of the previous year. This result is due to an increase in expenditure of 4.6%, while revenues grew at a rate of 3.1%.

Taxes grew by 4.4% to €6.225 billion. Of these, taxes on production and imports amount to €1.186 billion.

Income and wealth tax revenues increased by 3.4% to a total of €4.857 billion, of which €4.770 billion corresponded to payments on account made by the State, an increase of 3%. Revenue from capital taxes amounted to €182 million.

Transfers between public administrations amounted to €8.447 billion. Of the above amount, transfers received from the State through the financing system grew by 1%, from €6.708 billion at the end of January 2023 to €6.775 billion in the same month of 2024.

At the same time, revenues from other sources amounted to €1.207 billion, 3.8% higher than in January 2023.

On the expenditure side, compensation of employees grew by 6.4% to €7.573 billion. Intermediate consumption rose 1.5% to €3.286 billion. Subsidies amounted to €252 million, an increase of 15.6% compared to the end of January 2023, mainly due to the increase in product subsidies. Meanwhile, interest income increased 34.5% to €557 million.

Social transfers in kind rose by 5.5%, an increase of €135 million to €2.592 billion. This heading includes expenditure on pharmacy with an increase of 10.7 % (110 million more) to €1.138 billion, health care agreements with an increase of 8.6 % (€37 million more) to €465 million, and educational agreements to €689 million.

Social Security Funds

The Social Security Funds at the end of January 2024 recorded a deficit of €318 million, 38.4% lower than the deficit for the same period in 2023. In terms of GDP, Social Security deficit stands at 0.02%, compared to 0.04% of GDP in 2023.

There was a 8.2% growth in revenues (notably the good performance of contributions with growth of 8.6%) compared to a 6.8% decrease in expenses.

It should be remembered that in January 2023 the Intergenerational Equity Mechanism began to be applied, which consists of an additional final contribution applicable to all schemes and in all cases in which contributions are made for the contingency of retirement, which will not be taken into account for the purposes of benefits and which will be allocated to the Social Security Reserve Fund. In 2024, this additional contribution is 0.7 percentage points, while in 2023 it was 0.6 percentage points. Also noteworthy is the revaluation of contributory pensions by 3.8% for the year 2024.

In the first month of 2024, the Social Security System recorded a deficit of €558 million, or 0.04% of GDP, compared with a deficit of 0.05% in January 2023. Resources amounted to €15.153 billion, 8.3% higher than in 2023. The 8.9% increase in social security contributions stands out. The number of people affiliated to the system on a monthly average across all schemes increased by 2.6% compared to 2023. Expenditure amounted to €15.711 billion euros, largely corresponding to pension expenditure, which grew 6.6% to €13.027 billion.

As in previous years, the State Public Employment Service (SEPE) obtained a surplus of €219 million, 28.1% higher than in 2023, when it was €171 million.

FOGASA showed a surplus of €21 million, compared to a surplus of €5 million in the same period of 2023.

Non official translation