Budgetary execution 2022

Spain improves forecasts and closes 2022 with a deficit of 4.8% of GDP thanks to strong economic growth and job creation

News - 2023.3.30

General government closed the financial year 2022 with a deficit of 4.81% of GDP, or €63.78 billion, including financial aid. This is a reduction of 23.1% compared to the previous year. In other words, despite the difficult context experienced last year with the rise in prices due to the Russian invasion of Ukraine, the deficit decreased by 2.1 percentage points and improved the forecast communicated to the European Commission by 5%. The deficit has fallen to 4.73% of GDP if financial assistance is deducted. This is the third consecutive year that the final figure has been below the reference rate.

Moreover, compared to 2020, when the deficit reached 10.1% due to employment protection and pandemic measures, the deficit has been more than halved (by 53%). Specifically, in two years it has fallen by more than 5 percentage points, the largest decline in history for such a short period, without including financial assistance in the balance. This means that since 2020 Spain has reduced its public deficit by €49.5 billion.

This significant reduction in the deficit has been achieved thanks to a government policy which, far from cutting public services as was the case with previous executives, has been based on protecting the country's social majority by strengthening the Welfare State, boosting economic growth, promoting the creation of quality employment and committing to the transformation of the production model supported by European funds.

In this regard, the fall in the deficit is mostly due to the strong performance of the economy with a 5.5% increase in GDP for the second consecutive year, which allowed Spain to lead the growth of the large EU economies in 2022. Positive employment developments, with record social security enrolment, has also allowed progress to be made in fiscal consolidation.

Both variables, economic growth and employment, contributed to an increase in revenues in 2022 of 14.4% in cash terms. The contribution of inflation to this increase was only 5 points. However, the government has allocated much more resources to measures to mitigate the impact of rising prices. The tax reductions, direct aid, bonuses and subsidies approved by the government amount to €35 billion and, of this figure, €22.22 billion have had an impact on the 2022 financial year.

In fact, of the 4.8% deficit in 2022, 1.7 percentage points of GDP corresponded to the measures taken by the government to alleviate the inflationary crisis resulting from the war. This means that had it not been for the energy crisis, Spain would have closed 2022 with a deficit similar to pre-pandemic levels. The fiscal measures to combat rising energy prices have enabled households to save more than €8 billion.

This decisive reduction in the deficit is accompanied by an improvement in the efficiency and quality of public finances through the recommendations made by AIReF in its spending reviews. According to the Monitoring Report on the Recommendations of the Spending Reviews carried out by the Ministry of Finance, of the 277 recommendations made by AIReF in its spending reviews, 100 have already been implemented and 154 are in the process of being implemented.

Public administrations deficit

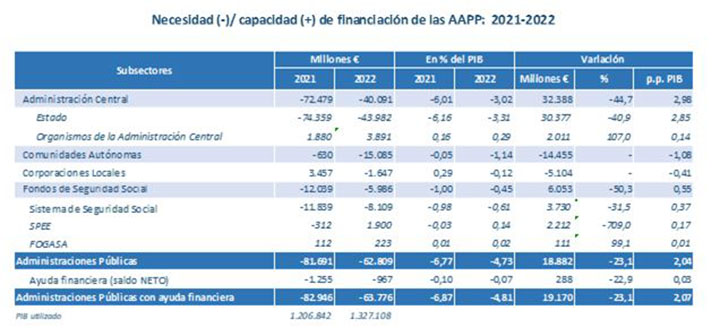

If the deficit is analysed by sub-sector, the central government and social security performed very positively, enabling the reduction of the general government deficit as a whole.

Specifically, the central government closed with a deficit of €40.10 billion (3.02% of GDP) excluding financial aid; the Autonomous Regions recorded a deficit of €15.09 billion (1.14% of GDP); the local governments had a deficit of €1.65 billion (0.12% of GDP); and the Social Security Funds a deficit of €5.99 billion (0.45% of GDP).

On the resources side, in national accounting terms, revenues increased by 8.1% (€42.60 billion), mainly due to higher tax revenues (€33.88 billion), and to the positive evolution of social security contributions, which grew by 4.8%.

On the expenditure side, which increased by 3.8%, the following items were the most important: intermediate consumption (9.7%), compensation of employees (4.2%), interests (21.3%) and subsidies (45.5%).

Tax revenue performance

If tax revenues are analysed in cash terms, data from the Tax Agency show that they rose to €255.46 billion, an increase of 14.4% over the figure for 2021.

The increase in revenue in 2022 is mainly explained by economic growth reflected in higher consumer spending and corporate profits - with the additional contribution of positive contributions from annual returns corresponding to tax bases in 2021 - and in improved employment and wages.

The impact of inflation was not the most important element in revenue collection, contributing only 5 points. In this regard, the taxes that increased the most were corporate and personal income tax, linked to the good performance of the economy and employment.

Thus, personal income tax revenues grew by 15.8% in 2022 to €109.49 billion. Almost half the total revenue growth comes from this figure. The main reasons for the growth are the increase in labour income (wages and pensions), the good results of the 2021 annual return filed at the end of June 2022 and the increase in personal business profits.

Corporate income tax revenues grew by 20.8% to €32.18 billion. This is a reflection of the favourable earnings development in both 2022 and 2021. The former were manifested in a strong increase in instalment payments (17.7%), which was also generalised by type of company, although is particularly high in consolidated groups and, within them, in groups in the banking and energy sectors.

In 2022, VAT revenues grew by 13.9% to €82.60 billion. The growth would be 16% if uncollected revenues from tax rebates on energy consumption were added. Excise duties grew by 2.5% overall in 2022 to €20.22 billion.

Central Government

Central Government recorded a deficit of 3.02% of GDP excluding financial assistance of €967 million. Including financial assistance, the central government deficit is 3.09% of GDP. This is a reduction of 3 percentage points of GDP from 6.11% in 2021. In fact, most of the deficit reduction effort in 2022 was made by the central government.

- The Government deficit is equivalent to 3.31% of GDP, or €43.98 billion.

- Central Government Agencies have recorded a surplus of €3.9 billion, excluding financial assistance, compared to a surplus of €1.88 billion in 2021. Including financial assistance, the surplus would be €2.92 billion.

State deficit

In 2022, the state recorded a deficit equivalent to 3.31% of GDP, compared to 6.16% in December 2021. This brings the deficit to €43.98 billion, down 40.9% from €74.36 billion in the same period of the previous year. This result is due to an increase in non-interest income of 19.6%, compared to expenses, which decreased slightly at a rate of 4.3%.

The primary deficit, net of interest, has been reduced by 69.3% to €15.68 billion and represents 1.18% of GDP.

Non-financial resources amount to €262.12 billion, 19.6% more than in 2021. Taxes amounted to €210.43 billion, 80.3% of total resources, and grew 16.2% compared to December 2021.

In 2022, non-financial government expenditure stood at €306.10 billion, 4.3% higher than in 2021.

The largest item is transfers between public administrations, with a weight of 58% of total non-financial uses. Specifically, in the first nine months of the year they amounted to €177.68 billion, an amount that includes the 2017 SII-VAT compensation paid to the Regional Governments for €3.09 billion, as well as the allocation to the Regional Governments to cover the loss of resources derived from the overall negative balances of the 2020 settlement, which amounted to €4.43 billion.

In turn, the Social Security Funds received 7.6% less resources than in 2021 due to the reduced needs resulting from pandemic protection measures. In this regard, transfers to the SEPE have been reduced by 74.9% due, among other reasons, to lower resource needs following the end of ERTES and other COVID benefits. Transfers to the Social Security System, on the other hand, increased by 1.3%. They are mainly used to finance operations such as dependency, pensions, minimum supplements, Minimum Basic Income, etc. They also include transfers made under the First Recommendation of the Toledo Pact 2020.

Employee compensation grew by 4.1%. This heading includes the effect of the annual pay increase for 2022 of 3.5%, while the 2021 wage increase was 0.9%.

Intermediate consumption amounted to €6.58 billion, 34.6% more than in 2021 due to the increase in spending on hosting refugees and stockpiling vaccines, while social transfers in kind increased by 57.2%, including €109 million allocated to the youth cultural voucher, with no corresponding amount for the previous year. This heading also includes free tickets for local and medium-distance trains.

Accrued interest grew 21.9% to €28.30 billion, while social benefits other than social transfers increased by 6.5%, a figure that includes a 2.5% revaluation of pensions for general pensions and 3% for minimum pensions.

For its part, expenditure on subsidies for production and products increased by €9.26 billion to a total of €15.35 billion, which this year includes the aid and subsidies provided for in RDL 6/2022 of 29 March, such as the extraordinary and temporary subsidy on the retail price of certain energy products and additives used for vehicle propulsion, and aid to the transport sector and to gas-intensive companies.

Gross fixed capital formation stands at €8.61 billion, 18% higher than in 2021, reflecting that the public sector continues to act as a locomotive of growth.

Last, the total of the headings included in other uses amounted to €25.83 billion, so that current international cooperation increased by 23.9%, including €298 million in vaccines donated to third countries and 74 million in defence material donated to Ukraine.

Social Security

Social Security Funds in 2022 recorded a deficit of €5.99 billion, compared to a deficit of €12.04 billion in the same period of 2021. In terms of GDP, the social security deficit stands at 0.45%, compared to 1.00% of GDP a year ago. This means that social security has improved its result by 50.3%, contributing together with central government to the decline in the balance of general government as a whole, as the social security balance has improved by 0.55 percentage points of GDP with respect to 2021.

This is the result of 2.4% growth in revenues (notably the good performance of contributions with growth of 5.1%) compared to a 0.6% decrease in expenses.

Since March 2020, the operations of the Social Security Funds subsector have been directly affected by the crisis resulting from the COVID-19 pandemic. However, progress in its control, particularly with the vaccination process, has led to a reduction in its economic impact. In 2022, the estimated impact was €2.18 billion, 78.4% lower than in the same period of 2021.

With regard to the regulations applicable to operations in the subsector, a mention should be given to Royal Decree-Law 32/2021 of 28 December on urgent measures for labour reform, guaranteeing employment stability and the transformation of the labour market. This regulation establishes new types of ERTEs from 1 April, as well as the activation of the RED mechanism for travel agencies.

Also Royal Decree-Law 6/2022 of 29 March approving the government's National Response Plan to the economic and social consequences of the war in Ukraine. Also Royal Decree-Law 11/2022 of 25 June extending the transitional increase of 15% in the Minimum Basic Income benefit and in non-contributory retirement and disability pensions. Last, RD 65/2022 and RD 152/2022 updated contributory pensions by 2.5% and non-contributory pensions by 3%, and set the minimum wage at €1,000.

The social security system has reduced the deficit by 31.5% from €11.84 billion in 2021 to €8.11 billion in 2022. This is €3.73 billion less. Resources have amounted to €178.20 billion. The 4.8% increase in social security contributions stands out. The number of people affiliated to the system on a monthly average across all schemes increased by 2.4% in 2022. Expenditure, for its part, amounted to €186.31 billion, largely on pension expenditure, which grew 5.1%.

As was already the case in 2021, the data recorded by the State Public Employment Service (SEPE), shows a surplus of €1.9 billion. This is largely due to the 89.6% decrease in all unemployment benefits linked to ERTEs and other COVID measures, which amounted to €534 million, while in 2021 expenditure rose to €5.1 billion in this period. The remaining unemployment benefits are down 1.1% compared to the previous year due to a better labour market evolution.

Meanwhile, FOGASA showed a surplus of €223 million, compared to a surplus of €112 million in the same period of 2021.

Regional Governments

The regional administrations recorded a deficit in 2022 of €15.09 billion, equivalent to 1.14% of GDP, compared to a surplus of 0.05% in 2021. This increase in the regional deficit is due to the lower extraordinary resources linked to the pandemic transferred outside the financing system.

In any case, in 2022 the autonomous regions received an additional €7.5 billion from the 2017 SII VAT and from the compensation of the negative liquidations of 2020. Since the start of the pandemic in 2020, the autonomous regions have had €37 billion from outside the state funding system to guarantee the provision of quality public services. This makes Spain the decentralised country that has protected its territories the most during this period.

In 2022, regional government expenditure rose by 5.4%, while revenue fell by 1%. The main source of funding for the autonomous regions is transfers from other public authorities, which amounted to €121.95 billion. Of the above amount, €117.7 billion corresponds to current transfers received (85% from the state).

Transfers received through the financing system grew by 4%, an increase of €3.11 billion. The resources outside the system include €3.09 billion from the compensation for VAT revenue foregone as a result of the implementation in 2017 of the Immediate Supply of Information (SII-VAT), and the transfer to cover the loss of resources arising from the overall negative balances of the 2020 settlement, amounting to €4.43 billion.

Taxes have increased by 5.4% (€3.96 billion more). Taxes on production and imports increased 18.1% to €19.75 billion, with an increase in ITP and AJD (property taxes) of 14.5%.

Meanwhile, income and wealth tax revenues increased by 1.8%, to a total of €53.69 billion. Revenues from capital taxes amounted to €3.25 billion, 0.4% more than in 2021.

Revenues from the rest of resources amounted to €22.99 billion, including the resources accrued in 2022 from the ERDF and the ERDF REACT-EU.

On the expenditure side, compensation of employees grew by 4.1%. This development is due, among other things, to a wage increase of 3.5% for 2022, while in 2021 the increase was 0.9%.

Intermediate consumption rose 2.6% to €37.36 billion. This heading covers the vaccines made available to the regional governments, amounting to €1.18 billion in 2021 and €473 million in 2022.

Subsidies also grew by 25.8% to €5.6 billion. This development is due, among other reasons, to the increase in public transport subsidies. Meanwhile, interest income increased 6.4% to €3.6 billion.

Social transfers in kind rose by 5.2% to €34.58 billion, with spending on pharmaceuticals increasing by 4.6%, spending on health care agreements by 5.9% and spending on educational agreements by 1.9%.

Social benefits other than transfers in kind amount to €4.97 billion, an increase of 1.3% compared to 2021, largely due to dependency benefits. Investment grew 0.9% compared to 2021 and reached €14.32 billion.

Transfers between general government increased by €10.43 billion. This increase is mainly due to the effect in favour of the state of the final settlement for 2020, which was €8.45 billion more than the final settlement for 2019.

The distribution of the deficit by regional government is as follows:

Local Bodies

Regional administrations recorded a deficit of €1.65 billion, equivalent to 0.12% of GDP, compared to a surplus of 0.29% in 2021. This negative balance is cyclical and of a technical nature. In particular, this is due to the negative settlement faced by Local Bodies, because in 2020, despite the fall in tax revenues, the state did not change the payments on account to the Territorial Administrations ,so that they could continue to provide their services with quality.

The government is going to compensate this negative liquidation of the EELLs in three years (2022, 2023 and 2024), following the Local Treasuries Law. In compliance with accounting rules, the negative settlement of 2020, amounting to €2.9 billion, is all imputed in 2022. Compensation, on the other hand, will be imputed over three years. This decoupling explains why local governments ran deficits in 2022. In fact, if this effect were not taken into account, Local Bodies would have closed last year with a slight surplus. This is therefore an accounting issue that will be reversed in 2023 and 2024, and the effect of the payment of the settlements will mean more surpluses for the municipalities.

Analysing the revenue performance shows an increase of 7.7% compared to 2021, an increase of €6.26 billion. This improvement was driven by higher tax revenues, which grew by 1.7%, reflecting the improvement in economic activity.

The second source of financing corresponds to transfers received from other public administrations with €35.5 billion, 15.3% higher than at the end of 2021. This increase is mainly due to higher resources received from the state, 18.4% higher than in 2021.

Expenditure, on the other hand, increased by 14.6%. The main increases were in compensation of employees, which grew by 5.1%; intermediate consumption increased by 13.6%; transfers between public administrations increased by 34.3%; and last, gross capital formation grew by 24.9%.

Non official translation