Pool Moncloa

Pool Moncloa

Article 31 of the Spanish Constitution requires the contribution of all to the support of public spending in accordance with their economic capacity by means of a fair tax system inspired by the principles of equality and progressiveness which, under no circumstances, shall be confiscatory in scope.

Levies-taxes, fees and special contributions-are means of obtaining the resources necessary to support public spending. Paying taxes helps to finance the public services of the state, regional and local administrations.

What is Personal Income Tax?

Personal Income Tax (IRPF) is a tax payable to the State by citizens resident in Spain. It taxes the income earned over the course of a year, taking into account the personal and family circumstances of each person.

What is income for Personal Income Tax purposes?

The taxpayer's income is the total of their income, capital gains and losses and the income allocations established by law, irrespective of the place where they were produced and irrespective of the taxpayer's residence.

Specifically, the return comprises:

- Income from work: consideration or profits, in cash or in kind, deriving, directly or indirectly, from personal work or from the employment or statutory relationship and not having the character of income from economic activities, such as wages and salaries, unemployment benefits or pensions).

- Income from real estate and movable capital: consideration or profits, in cash or in kind, which comes, directly or indirectly, from assets, goods or rights owned by the taxpayer and which the taxpayer does not need in order to obtain business or professional income (as opposed to, for example, the property where the taxpayer carries out their activity).

- Income from economic activities (e.g. manufacturing, trade or services, including crafts, agriculture, forestry, livestock, fishing, construction, mining, liberal professions, artistic and sporting activities).

- Capital gains and losses.

- Income allocations established by law.

There is a personal and family minimum that, because it is intended to cover the vital needs of the taxpayer and their dependants, is not subject to taxation.

Also exempt is income that is expressly qualified as such under Personal Income Tax regulations or other law. The exemption cannot be invoked outside the cases provided for in the law.

Who must pay this tax?

Individuals who have their usual residence on Spanish territory and those who have their usual residence abroad in the cases set out in Articles 8, 9 and 10 of Law 35/2006 of 28 November.

What percentage of income do I pay for Personal Income Tax?

The percentage of the income earned that is paid to the State depends, firstly, on the type of income. Savings income is taxed at a lower rate than non-savings income, known as general income.

This general income is taxed according to a progressive scale: the percentage of income that is paid for Personal Income Tax increases as income increases. In this way, people with lower incomes are favoured.

The brackets for the 2023 Personal Income Tax return are*:

· From 0 to 12,450 euros: 19% withholding.

· From 12,450 to 20,199 euros: 24% withholding.

· From 20,200 to 35,199 euros: 30% withholding.

· From 35,200 to 59,999 euros: 37% withholding.

· From 60,000 to 299,999 euros: 45% withholding.

· Over 300,000 euros: 47% withholding.

*This table is an estimate by adding the state and regional taxes, taking the rates applicable to non-resident taxpayers in Spain as a reference for the latter.

Moreover, the taxpayer is not taxed on all their income at the highest withholding rate, but the percentages are applied one by one, starting with the lowest. For example, if a person earns 22,000 euros gross per year, they do not pay 30% of that total for Personal Income Tax, but 19% for the first 12,450 euros, 24% for the next 7,750 euros (second bracket) and 30% for the remaining 1,800 euros (third bracket).

The 2024 personal income tax brackets, which will affect tax returns to be filed in the 2025 income tax campaign, have not changed for the moment.

What are the functions of the Tax Agency with regard to Personal Income Tax?

The State Tax Administration Agency (AEAT), attached to the Ministry of the Treasury and Public Function, is responsible for the effective application of the state tax and customs system.

It is responsible for managing, inspecting and collecting state taxes, including Personal Income Tax.

The AEAT has a basic tax information telephone service for queries: 91 554 87 70, also accessible on 901 33 55 33. Its opening hours are Monday to Friday, from 9 am to 7 pm (until 3 pm in August).

What services are available to me to file my Personal Income Tax return?

As in the previous campaign, the AEAT offers taxpayers various services to help them file their tax returns, either in person or through its e-office (Renta WEB), by telephone (Plan "Le llamamos") or using the "Agencia Tributaria" mobile application. The online and in-app submission options have several explanatory videos that detail both procedures.

In this campaign is also available the virtual assistant, with expanded information, through which it is possible to ask questions that will be answered in a personalized way.

There is also a simulator, Renta Web Open, which allows you to calculate the result of the declaration without the need for any type of prior signature, identification or authentication.

On the other hand, the website includes a guide with the main new features of the Personal Income Tax (IRPF) in the 2023 financial year, as well as specific information to facilitate the presentation of the declaration for people with disabilities and those over 65 years of age.

The elderly group will also be the beneficiary of one of the main novelties of the 2023 campaign: starting in May, a special assistance plan will be launched for people over 65 years of age who reside in small municipalities. Through this initiative, seniors who request an appointment (starting on April 29) will be assisted by AEAT staff through video assistance in the facilities made available by their town hall.

If you would like assistance from the Tax Agency, either by telephone or in person, you must make an appointment in advance, online or by calling one of these telephone numbers: 91 535 73 26 / 901 12 12 24 or 91 553 00 71 / 901 22 33 44.

When does the Personal Income Tax 2023 campaign begin and end?

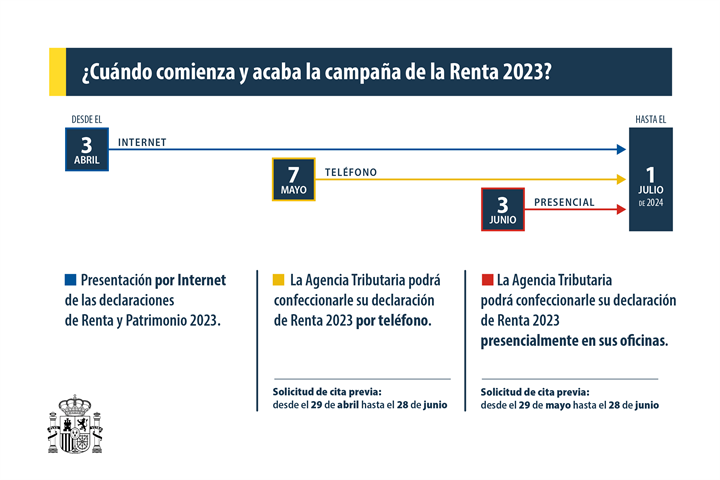

The dates for making the Income and Wealth Tax Return 2023 are as follows:

- 3 April to 1 July 2024: online filing of Income and Wealth Tax returns 2023.

- 7 May to 1 July 2024: the Tax Agency will be able to prepare your Income Tax Return 2023 by telephone (appointment request from 29 April to 28 June).

- 3 June to 1 July 2024: the Tax Agency will be able to prepare your Income Tax Return 2023 in person at its offices (appointment request from 29 May to 28 June).

Where can I consult my draft income tax return?

The draft income tax return and/or tax data can be obtained at the AEAT's e-office during the campaign.

The identification systems required for access are:

- Electronic certificate.

- System Cl@ve PIN.

- Reference number previously supplied by the AEAT.

Taxpayers may also consult the draft return through the "Agencia Tributaria" application, using the Cl@ve PIN system or the aforementioned reference number.

How can I confirm or amend my draft tax return and file it?

Confirmation and filing of the draft and, where appropriate, amendments may be made:

- In the draft/tax return processing service of the AEAT's e-office.

- In person, by appointment, at any AEAT Office or Administration, and also at the offices of the Tax Administrations of the Autonomous Communities and Cities with Statute of Autonomy that have signed a collaboration agreement for the implementation of the single tax window system.

- By telephone, by appointment, thanks to the "Le Llamamos" Plan, if the requirements stated in the AEAT's e-office are met.

- Through the "Agencia Tributaria" application if you do not have to amend or include any additional data in the draft return.

Non official translation