Council of Ministers

Government approves Draft National Budget for 2021

Council of Ministers - 2020.10.27

Moncloa Palace, Madrid

The Council of Ministers approved the presentation of the Draft National Budget for 2021 to Parliament, which includes a first tranche of the European Union Recovery Funds.

The Minister for the Treasury and Government Spokesperson, María Jesús Montero, highlighted that this Budget is essential to rebuild the country, as announced by the President of the Government, Pedro Sánchez, and the Second Vice-President of the Government, Pablo Iglesias, at a press briefing prior to the Cabinet meeting.

María Jesús Montero added that this is a Budget for economic growth, job creation and social cohesion, which comes at a time when the world is suffering from the worst pandemic we have seen in a century. "This is the Budget the country needs at this exceptional time".

María Jesús Montero reported that non-financial State spending amounts to 194.46 billion euros, a slightly higher figure than the one approved under the spending cap on 6 October.

The most important heading of spending is current transfers, which amount to 136.5 billion euros. Personnel spending registers a 4.2% increase, which includes a 0.9% pay rise for public servants. The heading of investment includes 19.67 billion euros of European funding while the heading to rise the least relates to servicing debt.

Spending Budget: highest spending on social issues ever

Pensions and social services

Foto: Pool Moncloa/Borja Puig de la BellacasaThe Government Spokesperson highlighted that social spending, which amounts to 239.77 billion euros, is the highest figure ever budgeted, and amounts to a 10% rise on last year and includes almost 9 billion euros of European funding. Without the support from these funds, it would rise by 6%, specified the minister, who stressed that the item of social spending is in the government's DNA.

Foto: Pool Moncloa/Borja Puig de la BellacasaThe Government Spokesperson highlighted that social spending, which amounts to 239.77 billion euros, is the highest figure ever budgeted, and amounts to a 10% rise on last year and includes almost 9 billion euros of European funding. Without the support from these funds, it would rise by 6%, specified the minister, who stressed that the item of social spending is in the government's DNA.

The 0.9% rise in pensions and 1.8% rise in non-contributory benefits will help more than 10 million people. María Jesús Montero underlined that the government thus meets its commitment to guarantee that pensioners do not lose their purchasing power.

The items allocated to social services and protection are increased by 70.3% when including the European funds. The Government Spokesperson stressed that the fight against poverty and social exclusion is a priority pillar of the Budget. "The policies to combat child poverty will receive a 59% rise in the allocation on previous years".

Similarly, María Jesús Montero underlined that the Budget includes 3 billion euros to consolidate Minimum Living Income, which will benefit some 850,000 households and is "a strategic weapon in the fight against extreme poverty".

Another measure that helps the most vulnerable groups is the 5% rise in the Public Income Indicator of Multiple Effects (Spanish acronym: IPREM), which is the index used as a benchmark for the granting of support, subsidies and unemployment benefits.

The minister also stressed that maternity and paternity leave will be brought in line for the first time in Spain, by extending the latter from 12 to 16 weeks.

The item to fight gender-based violence will amount to 180 million euros, thus complying with the State pact to combat this scourge signed with the political formations.

Largest item on grants ever

The Budget guarantees quality public education with a rise in the allocation of 70.2%, including European funding, aimed at enhancing the digital skills of both teachers and pupils, and at boosting vocational training and extending nursery education for those up to 3 years old, in collaboration with the regional education authorities.

María Jesús Montero argued that the talent of young people cannot be limited by their family income, and hence the public accounts provide for the largest item on grants ever: 2.09 billion euros, up 514 million on the previous year.

Unprecedented health financing

The Government Spokesperson announced that the Budget will strengthen the capacity of the health system in response to the COVID-19 pandemic and improve the capacity for response in terms of prevention, care, hospitals and primary care.

The investment in health rises by 75.3%, with an allocation of 7.33 billion euros, including both national and European funding. María Jesús Montero said that "this is an opportunity for the whole of the health system to be strengthened in those areas identified as the most critical".

Jobs and housing

Unemployment policies will have an additional provision of 4.19 billion euros to respond to the needs stemming from the pandemic and the allocation to foster job creation will rise by around 30%.

The Budget also contains a 25% rise in housing policies on the previous year, in addition to actions financed under the European mechanism.

In total, announced the Minister for the Treasury, the government will allocate more than 2.25 billion euros to promote affordable housing, the construction of housing - mainly public - and refurbishments to incorporate energy efficiency systems.

Research, digitalisation and strategic industry

Foto: Pool Moncloa/JM CuadradoThe public accounts, explained the minister, will boost competitiveness through innovation, research and knowledge in emerging areas. In this regard, there will be "an unprecedented effort in R&D+i and in digitalisation, which will receive 12.34 billion euros.

Foto: Pool Moncloa/JM CuadradoThe public accounts, explained the minister, will boost competitiveness through innovation, research and knowledge in emerging areas. In this regard, there will be "an unprecedented effort in R&D+i and in digitalisation, which will receive 12.34 billion euros.

María Jesús Montero declared that the government's goal is to make industry - which receives a budgetary rise of more than 5.69 billion euros - a strategic sector with a greater weighting in the economy. "We want to boost an increasingly more sustainable, viable and digitalised industrial fabric within a carbon-free and circular economic project".

Similarly, the items for SMEs, trade and tourism will rise by more than 1.3 billion euros.

Another of the more significant rises in spending items relates to infrastructures, which will receive more than 11.53 billion euros.

European Funds

María Jesús Montero specified that 21% of the European funds will be allocated to industry and energy so as to foster the transformation of our productive system: 17.8% for research development, innovation and digitalisation, while resilient infrastructures and ecosystems will receive 17.6% of the funds, followed by healthcare, education, access to housing, trade, tourism and SMEs. "These resources have a two-fold aim: to move towards a model of sustainable, innovative and digital growth while strengthening these social policies".

Budget stability

The minister reiterated that the fact that this is an expansive Budget, boosted by the European Recovery Plan, does not mean that the government renounces the principle of budgetary stability.

The government has suspended the fiscal rules, recalled María Jesús Montero, but intends to clean up the public accounts and reduce the public deficit in 2021. "This year we estimate that the deficit will close at around 11.3%, and we forecast a reduction next year to7.7%".

According to forecasts, Central Government will reduce its deficit from 6.6% to 2.4%, while the deficit of the regional governments and local authorities could rise if they use any treasury surpluses they may have. The social security system is estimated to reduce its deficit to 3% because spending rose this year to combat the pandemic.

Revenue Budget

Foto: Pool Moncloa/Borja Puig de la BellacasaThe Minister for the Treasury claimed that the recovery in activity scheduled for next year will translate into an increase in tax collection. In fact, she stated, this collection is already performing better than the economy in 2020 because, although this has dropped as a result of less activity caused by the pandemic, it has done so at a lower percentage than the wealth of GDP. "In 2020, tax collection will fall by 7.6%, according to our forecasts, 3.6 points less than nominal GDP".

Foto: Pool Moncloa/Borja Puig de la BellacasaThe Minister for the Treasury claimed that the recovery in activity scheduled for next year will translate into an increase in tax collection. In fact, she stated, this collection is already performing better than the economy in 2020 because, although this has dropped as a result of less activity caused by the pandemic, it has done so at a lower percentage than the wealth of GDP. "In 2020, tax collection will fall by 7.6%, according to our forecasts, 3.6 points less than nominal GDP".

According to María Jesús Montero, this is not by chance but is due, among others, to the protection measures on income approved by the government, with Temporary Layoff Plans (Spanish acronym: ERTEs) as the main tool.

Specific tax amendments prior to a far-reaching tax reform

María Jesús Montero expressed the government's intention to address a far-reaching tax reform when the heath crisis has been overcome and economic stability is fully recovered. The minister claimed that it is necessary to adapt the current tax system to that of our European peer countries and the economic reality of the 21st Century, for example, the anachronism of having "analogue taxation for a digital economy".

The government, she announced, will appoint a committee of experts to advise it. For next year, however, specific tax changes have already been included, backed by national bodies, such as the Independent Fiscal Responsibility Authority (Spanish acronym: AIReF), and international bodies, including the European Commission, the International Monetary Fund (IMF) and the Organization for Economic Co-operation and Development (OECD).

The four aims of these tax adjustments are "to gain progressivity, foster the work of small and medium-sized enterprises, support healthy living habits and develop green taxation", according to the minister.

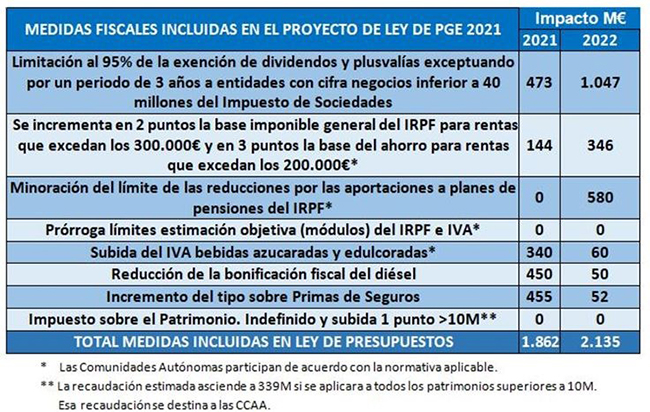

Personal income tax, corporate income tax and wealth tax

Personal income tax (Spanish acronym: IRPF) will rise by two points for income from work that exceeds 300,000 euros per annum. This rise, said the minister, will only affect 0.7% of taxpayers. As regards income on capital and savings, a rise of three points will be established as from 200,000 euros, a measure recommended by the OECD, and which will affect some 17,000 taxpayers out of a total of 21 million.

As regards corporate income tax, the Minister for the Treasury explained that in 2021 the current 100% exemption on capital gains tax and dividends generated by subsidiaries will be reduced to 95%, a measure "that will affect 1,730 companies, 0.12% of the 1.5 million incorporated in our country". Companies with turnover of less than 40 million euros may continue to apply the 100% exemption for the next three years.

Wealth tax will become indefinite and rise by one point, from 2.5% to 3.5% on the last tranche, which is above 10 million euros. María Jesús Montero announced that the government provides for this tax transferred to the regional governments to be harmonised throughout the country to avoid "unfair competition" between them and tax dumping.

Self-employed and pension plans

María Jesús Montero announced that the limits on the module system for the self-employed will be extended until 2021 to thus help support one of the groups worst affected by the crisis.

As regards individual pension plans, the limit on maximum contributions will drop from 8,000 to 2,000 euros, in line with the recommendations made by AIReF and the European Commission. According to María Jesús Montero, this measure will affect a very small number of taxpayers, given that, according to figures from AIReF, only 8% of them make contributions in excess of 4,000 euros, while 58% of them do so below 1,000 euros.

Rise in VAT on sugary and sweetened drinks

Sugary and sweetened drinks will be taxed by VAT at a rate of 21%, with the aim of combating obesity in children and associated diseases such as diabetes. These drinks will continue to be taxed at 10% in bars and restaurants "so as not to prejudice these businesses at such a delicate time as at present", stated the minister.

Green taxation

Foto: Pool Moncloa/Borja Puig de la BellacasaMaría Jesús Montero stated that one of the government's priorities is to further develop policies that incentivise "protective conduct" for the environment and penalise "aggressors".

Foto: Pool Moncloa/Borja Puig de la BellacasaMaría Jesús Montero stated that one of the government's priorities is to further develop policies that incentivise "protective conduct" for the environment and penalise "aggressors".

Accordingly, the elimination of the tax discount on diesel has been proposed, such that the general national rate for diesel will rise from 30.7 eurocents per litre at present to 34.5. "This price remains lower than that for petrol", continued the minister, "put the aim is to gradually bring these two hydrocarbons in line as a clear message that we want to change our consumer habits regarding the automotive sector, and focus this on more sustainable mobility".

María Jesús Montero argued that the measure is not designed for tax collection purposes, and quoted by way of example that, for a 50-litre tank, the increase will only amount to 2.3 euros, VAT inclusive, or 3.45 euros a month for vehicles that do 15,000 kilometres a year.

The current tax on diesel for professional use will be maintained, as will discounted diesel.

Insurance premiums

The Minister for the Treasury finally highlighted the change, for the first time in more than 20 years, in the tax on insurance premiums. The current rate of 6% will rise to 8%, a percentage which is below the European average, stated the minister.

New taxes

María Jesús Montero pointed out that several already approved new forms of taxation will be introduced, such as the Tax on Certain Digital Services, and the Tax on Financial Transitions, and others that are under way, such as the tax on non-reusable plastic containers, which will be reflected in the future in the Revenue Budget for 2021, although they have not yet been included.

"These measures, together with the fight against tax fraud, will lead to a rise in tax revenue of 4.22 billion euros, which will be essential to maintain the Welfare State", she claimed.

Request for extension of state of emergency for six months

Pool Moncloa/JM CuadradoThe Council of Ministers agreed to request a six-month extension to the state of emergency from the Lower House of Parliament, declared on Sunday through Royal Decree 926/2020, of 25 October.

Pool Moncloa/JM CuadradoThe Council of Ministers agreed to request a six-month extension to the state of emergency from the Lower House of Parliament, declared on Sunday through Royal Decree 926/2020, of 25 October.

The Government Spokesperson explained that the request proposes to eliminate the current validity of mobility restrictions between 11 pm and 6 am, such that it will be the regional president, as the competent authority, who establishes these limits on timetables and others, according to the spread of the pandemic in their region.

María Jesús Montero insists that the state of emergency provides "constitutional protection" to the measures that regional governments apply to protect the health of their citizens and to flatten the curve in this second wave of the pandemic. In this regard, she once again called on people to contribute to this goal by responsibly complying with the health recommendations.

More than 28,000 places under Public employment Offer for 2020

The Council of Ministers approved the Public Employment Offer for 2020, with a total of 28,055 places for career civil servants and those on employment contracts.

18,323 places will be offered for Central Government, of which 9,227 will be on a competitive basis and 8,996 through internal promotion. This figure, stressed María Jesús Montero, is the largest internal promotion quota in the history of Central Government.

The rest of the places will be allocated to the State law enforcement agencies (5,540), the armed forces (1,857), the administration of justice (1,452), local authorities which could be enabled at a national level (549), public enterprises (256), Central Government teaching staff (47), staff at the Health Management Institute (26) and the General Council of the Judiciary (5).

Non official translation