Contents

Industry

Performance by the industrial sector in 2014 showed clear signs of stability following a significant improvement in 2013 when compared with 2012. Hence, industrial output in the first 11 months of 2014 showed a variance of 0% in November on the same month in the previous year, compared with an increase of 1.1% in October.

By destination group, the year-on-year trends in industrial output in November can be attributed to capital goods (whose Industrial Production Index (IPI) fell by 2.2%) and energy (which shrank by 5.1%, two points more than in the previous month), as well as commodities (which shrank by 0.3% in November after growing by 1.9% in October). In contrast, intermediate goods showed increased momentum (4.7% compared with 3.4% in the previous month).

When broken down by economic sector, industrial output reflects uneven performance. In this regard, the largest year-on-year downturns correspond to Energy Minerals (-7.3%), Garment Manufacturing (-11.6%), Pharmaceutical Product Manufacturing (-7.9%) and Machinery Manufacturing (-13.4%). In contrast, noteworthy IPI growth was posted in the following areas: Chemical Industry (7.5%), IT, Electronic and Optical Product Manufacturing (14.6%), Electrical Material and Equipment Manufacturing (8.6%), Coke and Refined Petroleum Products (15.6%) and the Tobacco Industry (4.3%).

In turn, domestic sales of industrial goods by large companies rose by 5.1% year-on-year in November, almost three points higher than in October. Furthermore, the PMI Index in the manufacturing industry stood at 53.7 in the fourth quarter of 2014, 0.6 points higher than in the third quarter (53.1).

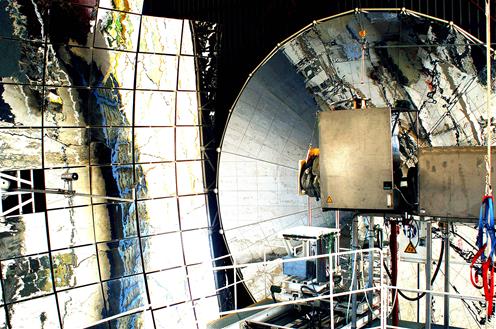

Complejo industrial (Ministerio de Economía, Industria y Competitividad)Having raised productivity from 1997 through to 2007, the industrial sector posted a 0.6% fall in productivity in 2008. Productivity in the sector has grown steadily since 2009. The highest growth of this variable was recorded in 2010 (10.1%), followed by increases of 4.3% in 2011 and 5.1% in 2012.

Complejo industrial (Ministerio de Economía, Industria y Competitividad)Having raised productivity from 1997 through to 2007, the industrial sector posted a 0.6% fall in productivity in 2008. Productivity in the sector has grown steadily since 2009. The highest growth of this variable was recorded in 2010 (10.1%), followed by increases of 4.3% in 2011 and 5.1% in 2012.

Industrial Policy

The primary goal of the industrial policy implemented by the Government of Spain is to allow industry to increase its contribution to GDP and job creation as much as possible.

Over the course of 2014, industrial policy was focused on maintaining the stimuli that are helping to promote innovative sectors of industrial activity, have a great export capacity and be capable of creating jobs, as well fostering access to new markets with high value-added.

In this regard, the facility offering financial aid for industrial investment was maintained through the programmes for re-industrialisation and the promotion of industrial competitiveness geared towards encouraging economically-viable business initiatives that help strengthen the competitiveness of industrial companies and foster the development of industry.

Schemes to stimulate vehicle demand have also been extended through successive PIVE Plans and programmes to encourage demand for electric vehicles.

Similarly, instruments supporting sectors with a significant knock-on effect were also maintained, such as the shipbuilding industry, aeronautics and the automotive industry, as well as such technology sectors as pharmaceuticals and the space industry.

In 2014, efforts were made to promote facilities offering financial aid to offset indirect CO2 costs incurred by certain industrial sectors in their energy bills. The first announcement of funding in this regard is scheduled to take place in 2015.

Industrial Property Rights

Spain is a signatory state of the main international treaties on industrial property rights. According to indicators published by the World Intellectual Property Organisation, Spain was the world's seventh leading country in terms of trademark and industrial design applications.

In recent years, the Government of Spain has implemented its Plan PI to promote industrial property in Spain and, since 2012, the 2012-2014 Strategy concerning industrial property for businesses and entrepreneurs in order to encourage the strategic use of patents, trademarks and designs from the Spanish business sector. The 2012-2014 Strategy is an initiative by the Ministry of Industry, Energy and Tourism through the Spanish Patent and Trademark Office intended to transform industrial property into a tool and key factor in day-to-day decision-making in business and among entrepreneurs. The aim of the strategy is to foster the differentiation, specialisation and improved performance of the Spanish productive system, thereby helping to improve the competitive position of Spanish companies in global markets through the strategic use of instruments for industrial property protection.

Energy

Production, Demand and Energy Dependency

Primary energy output in Spain amounted to 119,710 kilotons of oil equivalent (KTOE) in 2014, down 1.2% on 2013 (121,119 KTOE) as a result of a downturn in natural gas consumption (-14.8%), oil consumption (-2.4%) and the electricity balance (-49.1%), which failed to offset the moderate increases in nuclear, renewables and non-renewable waste and the significant increase in the use of coal - up 25% on the previous year.

Molinos eólicos (Ministerio de Economía, Industria y Competitividad)By energy source, the bulk of primary energy output in 2014 came from oil (43.1%), followed by natural gas (18.6%) and renewable energies (14.8%). Energy production from coal accounted for 11.1% and the electricity balance stood at -0.2%. At the end of 2014, the primary energy intensity of the Spanish economy in terms of primary energy/GDP - calculated according to the Eurostat methodology - stood at 128.1 KTOE/million euros. This represents an increase of 2.5% on 2013 (131.4 KTOE/million euros). The Spanish economy made more efficient use of domestic electricity and other forms of final energy, since the intensity thereof fell by 2.6%.

Molinos eólicos (Ministerio de Economía, Industria y Competitividad)By energy source, the bulk of primary energy output in 2014 came from oil (43.1%), followed by natural gas (18.6%) and renewable energies (14.8%). Energy production from coal accounted for 11.1% and the electricity balance stood at -0.2%. At the end of 2014, the primary energy intensity of the Spanish economy in terms of primary energy/GDP - calculated according to the Eurostat methodology - stood at 128.1 KTOE/million euros. This represents an increase of 2.5% on 2013 (131.4 KTOE/million euros). The Spanish economy made more efficient use of domestic electricity and other forms of final energy, since the intensity thereof fell by 2.6%.

In 2014, final energy demand amounted to 84,382 kilotons of oil equivalent (KTOE), down 1.2% on 2013. Electricity demand stood at 19,713 KTOE.

Breaking down final energy by source, total oil consumption accounted for 46.8%, followed by electricity (23.4%), natural gas (15.6%), renewable energies (6.5%) and coal (1.95%). The consumption of products for non-energy uses accounted for 5.8%, fundamentally consisting of oil products. As regards electricity in particular, renewable energies were the leading sources (39.3%), followed by nuclear (20.5%), natural gas (17.2%), and coal (16.7%).

Reform of the Electricity Sector

The Spanish electricity system has significant strengths, which include a diversified and balanced mix of generation technologies, high penetration of renewable energies (42.8% of the energy produced in 2014) and a high level of infrastructure development and supply quality.

For the past ten years, the Spanish electricity system has generated a tariff deficit (the difference between revenue and expenditure in the system). Over time, this had become a structural deficit because the actual costs associated with the regulated activities and operation of the electricity sector were higher than the revenue obtained from the access tolls set by the government and paid by consumers. Given the unsustainable nature of the electricity sector deficit, mainly caused by the exponential growth of certain costs in the system, urgent measures were necessary to rectify the situation. To correct the imbalances caused by the expansive development of the cost headings in the electricity system, a series of measures - some of them urgent - have been adopted since 2012 affecting both costs and revenues. Furthermore, a rule on financial stability has been established by law through an automatic review system that will avoid the emergence of new imbalances.

The measures put in place, the framework for which is provided by the new Electricity Sector Act 24/2013, approved in December 2013, are as follows:

- To establish basic regulation of the sector in order to guarantee electricity supply with the necessary levels of quality at the lowest cost possible and enable a level of effective competition in the electricity sector.

- A new system for setting electricity prices for domestic customers has been established - the Voluntary Price for the Small End-Consumer (Spanish acronym: PVPC), which has lowered bills. The new price is set directly and transparently according to the market price and has enabled energy costs to be lowered, competition to be increased, and transparency and consumer choice when contracting electricity supplies to be enhanced.

- Consumer protection: the most vulnerable consumers will still be entitled to benefit from the subsidised rate, which applies a 25% discount to their bill.

- To increase information for consumers (various tools have been created to help consumers understand their bills and compare different offers), introduce more competition (new benchmark marketing companies have been introduced) and foster transparency (bills have been simplified).

- To add stability in the electricity system by eliminating the tariff deficit and avoid generating new deficits, thereby ensuring economic and financial sustainability for the system.

- Limiting the ability to introduce new costs in the electricity system without them being offset by an equivalent increase in revenues.

- Assumption by regional or local authorities of any cost overruns generated by their regional or local regulations.

- To adapt remuneration from regulated activities in the electricity system with objective and standardised criteria, guaranteeing reasonable profitability for renewable, generation and waste installations and appropriate remuneration for all other regulated activities.

- As regards renewable, co-generation and waste installations, the reform provides for a new remuneration scheme. Such installations will receive a supplement for their investment costs based on technology standards, thereby ensuring reasonable profitability.

- As regards transport and distribution networks, a new remuneration methodology has been regulated that seeks to lower costs, make the system more efficient and include periodic review mechanisms. Asset control and auditing is increased, a new incentive for distribution companies to combat fraud is included and a maximum amount for investment to be borne as an annual cost by the electricity system is set.

- In the non-mainland systems (Canary Islands, Balearic Islands, Ceuta and Melilla), the reform introduces measures to lower the cost of electricity generation and improve power station efficiency and competition. A basic system of incentives is also introduced in these regions for wind power and photovoltaic energy, as they are cheaper than conventional generation.

- The possibility to temporarily close facilities (hibernation) is allowed under strict conditions that ensure supply security.

Central eléctrica (Ministerio de Economía, Industria y Competitividad)The following results have been achieved since the reform:

The tariff deficit in the electricity system has been resolved, thereby avoiding a 42% increase in electricity prices which is what would have happened to customer's bills had the reform not been implemented. For the first time in ten years, 2014 posted a balance between revenue and costs in the electricity system.

The reform has not only avoided a continued rise in electricity prices but caused prices to fall over the last two years. The reform has helped consumers in general and households in particular.

The reform has provided regulatory security, certainty and confidence among investors and companies.

Reform of the Gas System

Demand for natural gas in Spain has been falling since 2008. Current demand is on a level with that posted in 2004 and forecasts show that a level of demand equal to that in 2008 will not be achieved until 2020 or beyond. However, costs in the gas system (regasification, transport, distribution and storage) have increased significantly due to the construction of infrastructures in line with a planning schedule that considered an average annual increase in demand for natural gas of 3% over the period 2008-2016.

As a result of this increase in costs and fall in demand, the latter also leading to the under-use of gas system infrastructures, a structural tariff deficit has occurred since 2008.

Hence, in 2012, the first deficit containment measures were adopted in Royal Decree-Law 13/2012, of 30 March, and Royal Decree-Law 8/2014, of 4 July, on the approval of urgent measures for growth, competitiveness and efficiency was passed in 2014 given the ongoing fall in demand and deficit forecasts for the close of the year. The latter was validated by means of Law 18/2014, of 15 October of the same name, guaranteeing the economic and financial sustainability of the gas system.

The goal of these measures is to resolve the tariff deficit in the gas system and guarantee a system that is economically sustainable in the future where remuneration from regulated activities has been adjusted to suit trends in demand.

Furthermore, an amendment to Law 34/1998, of 7 October, on the hydrocarbons sector is currently in its passage through Parliament that will enable the creation of an organised natural gas market capable of facilitating purchase-sale transactions, fostering the entry of new stakeholders and providing a transparent price benchmark, thereby guaranteeing supply security in the system.

National Energy Efficiency Fund

In order to ensure compliance by Spain with the binding energy-saving target for 2020 (15,979 KTOE in the period 2014-2020) set by Directive 2012/27/EU on energy efficiency, Royal Decree-Law 8/2014, of 4 July approved the creation of a National Energy Efficiency Fund that will enable the implementation of mechanisms for economic and financial support, technical assistance, training and other measures to raise energy efficiency in all sectors.

Tourism

The Current Situation of Tourism in Spain

In 2014, Spain was visited by 65 million inbound tourists (a new record). This represents a year-on-year increase of 7.1% or 4.3 million more tourists than in the previous year.

Three markets - the United Kingdom, France and Germany - accounted for 55% of all inbound tourists in 2014, eight points lower than the proportion represented by these countries ten years ago. They posted upward trends when compared with 2013 and the highest increases in absolute terms for the year - especially France, with 1.1 million additional tourists. The other main emitting markets also posted increases when compared with 2013, except for Russia, which shrank by 10%.

Parador de Cádiz (Ministerio de Energía, Turismo y Agenda Digital).The number of tourists travelling independently (70% of the total) grew more than those who opted to travel on a package holiday (7.5% compared with 6.3%). The number of independent travels increased from all the main markets - especially France - the only exception being the United States.

Parador de Cádiz (Ministerio de Energía, Turismo y Agenda Digital).The number of tourists travelling independently (70% of the total) grew more than those who opted to travel on a package holiday (7.5% compared with 6.3%). The number of independent travels increased from all the main markets - especially France - the only exception being the United States.

The number of inbound tourists rose in all destination autonomous regions when compared with 2013, with Catalonia leading this growth as the top destination and almost 1.2 million additional tourists.

Total spending by inbound tourists amounted to 63.09 billion euros in 2014, up 6.5% on the previous year and a new all-time record. The average spend per person fell slightly while the average spend per day remained practically the same as the previous year, at 971 euros and 110 euros, respectively.

As regards residents in Spain and according to preliminary data on 2014, the number of journeys made amounted to 152 million. This is approximately 2% fewer than the previous year. 92% correspond to domestic travel while the remaining 8% correspond to international tourism. The trends posted by the two types of travel were unbalanced. While the former posted a downturn the latter posted growth, as reflected by the increase in payments from tourism in the Balance of Payments. As regards domestic travel, the number of trips made to privately-owned properties or those owned by friends and relatives fell while those made to hotel accommodation posted an increase. This is reflected in the increase in overnight stays in hotels by residents shown in the Hotel Occupation Survey conducted by the National Institute of Statistics (Spanish acronym: INE).

After publishing its annual data, the World Tourism Organisation confirmed that Spain is the world's third-top destination for inbound tourists and the second-top country in terms of revenue from tourism (Balance of Payments). According to the International Congress and Convention Association, Spain was the world's third-top destination for meeting and conference tourism in 2013.

To November (most recent period available), the Balance of Payments shows increases in both revenue from tourism and payments for tourism (4% and 9.4%, respectively), amounting to 46.41 billion euros and 12.45 billion euros, respectively. The balance for this period under this heading shows a surplus of 33.96 billion euros, up 2.1% on the same period in 2013. In the period January-September 2014 (the most recent period for which trade balance information is available), the tourism and travel balance covers 174% of the Spanish trade deficit.

According to the latest data released by the Tourism Satellite Account (2012), the tourism sector accounts for 11% of GDP.

As regards employment, data from the Labour Force Survey (Spanish acronym: EPA) on the fourth quarter of 2014 and data on affiliation to the Social Security system in 2014 reveal the following:

- According to the EPA, the number of people employed in the tourism sector rose by 7.7% in the fourth quarter of 2014 to a total of 2,204,842. This group represents 12.5% of the workforce in the Spanish economy.

- Among those employed in the tourism sector, the number of salaried employees rose by 7.8% and the number of self-employed rose by 7.6%.

- The number of unemployed from tourism activities amounted to 423,304 in the last quarter of the year, with the percentage of unemployed over employed standing at 16.1% (compared with 18.9% the previous year). The unemployment rate in the national economy stood at 23.7%, compared with 25.7% in the same quarter of 2013.

According to the data on affiliation to the Social Security system, the average number of people employed in tourism activities in 2014 rose by 3.4% year-on-year to 2,001,448 workers registered with the Social Security system (12.1% of the total number of workers comprising the workforce in the Spanish economy).

Spanish Tourism Policy Objectives

Fully aware of the significance of tourism for Spain, the Ministry of Industry - through the State Secretariat of Tourism - has implemented the National Comprehensive Tourism Plan (Spanish acronym: PNIT) adopted by the Council of Ministers on 22 June 2012. The purpose of this plan is to improve the competitiveness of both businesses and destinations alike, increase profitability from industry and support Spain's global leadership in this sector. The plan constitutes the Government of Spain's strategy for the period 2012-2015. Between the time it was implemented and January 2014, 72% of the plan has been set in motion.

The strategic dimensions on which the PNIT is based are: the strength of the "Spain" brand, a customer-focused approach, offer and destination planning, alignment of public and private operators, the knowledge economy, talent recruitment and retention, and support for innovation and entrepreneurship.

As the Government of Spain's tourism policy does, the plan adopts a cross-cutting approach: all public authorities, all ministerial departments, private initiative and society have been involved in drawing up and implementing this plan.

Hence, numerous measures taken by other ministerial departments have had a positive influence on tourism. These include the labour reform, the amendments made to the Coastal Act, the speeding up of visa issues (for example, visa issues in China increased by 30% in 2013) and the modulation of airport charges.

Over the course of this legislature, it was also decided to enhance the role played by SEGITTUR - the State Company for the Management of Innovation and Technologies in Tourism that is managed under the Ministry of Industry, Energy and Tourism and overseen by the State Secretariat of Tourism.

SEGITTUR is charged with the task of driving innovation (R&D+i) in the Spanish tourism industry, in both the public and private sectors. In addition to its support for activities by Turespaña to date, SEGITTUR is acting as a spearhead for Spanish companies (mainly SMEs) that have committed to innovation in the tourism sector by helping them in their search for previously inaccessible overseas markets and boosting the internationalisation of companies in this sector.

The Policy for Promoting Tourism Abroad

The Spanish Tourism Institute (Turespaña) is the independent body of the General State Administration in charge of promoting Spain as a tourist destination in the international markets.

Through Turespaña, the Ministry of Industry has committed to a new promotion policy. First of all, it is based on new information and communication technologies and social media, moving away from traditional media. Secondly, priority markets have been identified and a process of segmentation has been applied to the demand from these markets. The idea is to focus promotional resources on those markets and products that most contribute to achieving the goal of increasing the profitability associated with tourist spending.

Oficina de Turismo (Ministerio de Economía, Industria y Competitividad)Within the priority markets, a distinction has been made between mature markets and emerging markets. Mature markets are already consolidated markets that produce the majority of inbound tourists who visit Spain. In these countries, the strategy is based on increasing the loyalty of tourists who visit Spain and attracting new demand segments that consume products other than traditional tourism products (art and culture, urban tourism, Spanish gastronomy, nature and conference tourism). On the other hand, the emerging markets are where Spain is mainly basing its promotion strategy on improving its position as a tourist destination.

Oficina de Turismo (Ministerio de Economía, Industria y Competitividad)Within the priority markets, a distinction has been made between mature markets and emerging markets. Mature markets are already consolidated markets that produce the majority of inbound tourists who visit Spain. In these countries, the strategy is based on increasing the loyalty of tourists who visit Spain and attracting new demand segments that consume products other than traditional tourism products (art and culture, urban tourism, Spanish gastronomy, nature and conference tourism). On the other hand, the emerging markets are where Spain is mainly basing its promotion strategy on improving its position as a tourist destination.

Overseas promotion takes place via the Spanish Tourism Offices. These offices undertake promotional activities in the emitting markets in collaboration with other stakeholders (regional governments, regional and local bodies and product clubs). Concerted actions are carried out in conjunction with other authorities and the private sector, which enable a joint effort to be made thus resulting in a greater impact and visibility.

In order to increase effectiveness and efficiency, the Ministry of Industry has begun a process to reorganise the geographic distribution of these offices in order to adapt their locations to the new challenges and criteria present in the tourism industry. All this work is being fully coordinated by the Advisory Council of Turespaña, which is almost entirely made up by the private sector.

Spain currently has a network of 33 tourist offices (managed under Turespaña) in 25 countries. The offices play an essential role for the Spanish tourism sector but their geographic and staffing structure still respond, for the most part, to conditions that existed when the majority of them were set up. The Ministry of Industry has therefore chosen to transform the network in terms of the role to be played by the offices, overseas personnel and their geographic location.

Telecommunications and the information society

The New General Telecommunications Act

The Telecommunications Act 9/2014, of 9 May, was approved in mid-2014. This new law contains a structural reform aimed at fostering competitiveness, creating jobs and guaranteeing investment by telecommunications operators that could amount to 25 billion euros over the next few years. It is a far-reaching structural reform as the changes being made make it easier for operators to roll out new networks and facilitate the spread of broadband, thereby building a faster Internet. These efforts are aimed at fostering the digital economy and creating new business models and economic growth.

The main new features approved in the new General Telecommunications Act are as follows:

- Facilitate the rollout of networks, making the resources needed to do so available to operators.

- Promote administrative simplification by eliminating licences and permits and unnecessary administrative burdens.

- Recover market unity and slow regulatory dispersion: new mechanisms have been designed for Central Government coordination and collaboration with the regional governments and local authorities that facilitate asset deployment, while common technical requirements have been established for network rollout, as well as common maximum limits throughout the country regarding the emission of and exposure to electromagnetic fields.

- Foster competition and improved services to users: the rights of telecommunications users regarding the protection of data of a personal nature and the privacy of individuals are improved, an inter-ministerial commission on radio-frequencies and health is created. Furthermore, the public is provided with: greater coverage and lower prices, greater choice, better quality and the defence of consumer rights, especially in disadvantaged areas.

- Services will also arrive sooner under this law given that it will facilitate the rollout of networks based on next-generation landline and mobile technology.

Satélite (Ministerio de Economía, Industria y Competitividad)The Digital Agenda for Spain

Satélite (Ministerio de Economía, Industria y Competitividad)The Digital Agenda for Spain

In March 2010, the European Commission implemented its Europe 2020 Strategy aimed at recovering from the crisis and preparing the EU economy for the challenges of the coming decade. Europe faces a major challenge: technologies in the information and telecommunications society have reached a distinctive level of maturity against the backdrop of rapid technological progress, and the new macro-economic scenario is forcing policies to be redesigned. This is the backdrop against which a Digital Agenda for Spain has been drawn up, which will allow the general lines set by the European Union to be adapted to the situation in Spain.

The Digital Agenda for Spain is the Government of Spain's strategy for developing the digital economy and society in Spain. The agenda provides a roadmap in terms of Information and Communication Technologies (ICT) and e-Government for achieving the objectives set out in the Digital Agenda for Europe in 2015 and in 2020, and incorporates specific targets for developing the digital economy and society in Spain. It is also the strategy underpinning the investments to be undertaken with money from the European Structural and Investment Funds (ERDF and ESF) during the period 2014-2020.

The agenda contains 106 lines of action grouped around six major objectives:

- To encourage the rollout of ultrafast networks.

- To develop the digital economy.

- To improve e-Government and digital public services.

- To foster trust in the digital environment.

- To encourage R&D+i in the industries of the future.

- To support digital inclusiveness and the training of new ICT professionals.

Its implementation and application is based around nine specific plans that incorporate 32 key indicators for tracking purposes (10 stemming from the Digital Agenda for Europe and 22 specific to the development of the digital economy and society in Spain). The nine plans are: Telecommunications and Ultra-fast Networks Plan; ICT in SMEs and e-Commerce Plan; Comprehensive Plan for the Digital Content Industry; Internationalisation Plan for Technology Companies; E-Government Action Plan of the General State Administration; Digital Public Services Plan; Plan to Boost Confidence in the Digital Arena; ICT Sector Development and Innovation Plan; and Digital Inclusion Plan. A tenth Smart Cities Plan will also be published as this proposal falls in line with numerous European initiatives and forms part of the priorities set by local councils and the ICT sector, as well as the platforms that coordinate the main cities in Spain (Spanish Network of Smart Cities), the industry (INERCIA Alliance) and the technology platforms (es.Internet), provincial councils, etc.

Achievements:

- Publication of eight specific plans from the Digital Agenda for Spain.

- 70% of the measures contained in the plans are being carried out or have been concluded.

- Implementation of initiatives with a provision of over 1.2 billion euros.

- Approval of the General Telecommunications Act with major political and sectorial consensus.

- The target of 100 Mbps coverage for 50% of the population has been achieved one year ahead of schedule.

- Implementation of successful calls for proposals for advice to small- and medium-sized enterprises on their transition to e-commerce and the digital environment.

- Organisation of the new International Digital Content Forum, FICOD.

- Creation of a mixed task force in conjunction with the Spanish National Agency for Quality Assurance and Accreditation (Spanish acronym: ANECA) for the design of University Training within the framework of the Digital Economy.

- Organisation of the Barcelona Mobile World Capital.

- Consolidation of INTECO as a benchmark centre in cyber-security, now called INCIBE (National Cyber-Security Institute).

- Reduction in bureaucratic burdens for accessing ICT R&D+i financial aid.

Key indicators of the Digital Agenda for Spain:

Target for 2015 | Situation in 2015 | Initial value in 2011 | |

|---|---|---|---|

Population with coverage of over 100 Mbps | 55% | 56% | 47% (2012) |

Population with FTTH coverage | 50% | 26% | 9% (2012) |

Homes connected at speeds of over 100 Mbps | 5% | 2.6% | 0.4% (2012) |

Population making online purchases | 50% | 37.4% | 27.3% |

People who have used security measures | 70% | 62.2% | 56% (2010) |

People using the Internet on a regular basis | 75% | 71.2% | 61.8% |

People from underprivileged groups using the Internet on a regular basis | 60% | 52.2% | 44.9% |

Population that has never accessed the Internet | 15% | 21% | 29.2% |

Mobile broadband penetration among mobile telephony users | 75% | 73.4% | 41.2% |

People who use e-Government services | 50% | 49% | 39.1% |