Oliver Wyman estimates the Spanish banking system's capital needs at close to €60 billion

News - 2012.9.28

The 14 main Spanish banking groups (taking into account the integration processes currently under way) have participated in this test. The groups account for around 90% of the Spanish banking system's assets.

The results confirm that the Spanish banking sector is mostly solvent and viable, even in an extremely adverse and highly unlikely macroeconomic setting:

- Seven banking groups, accounting for more than 62% of the analysed portion of the Spanish banking system's credit portfolio, do not have additional capital needs.

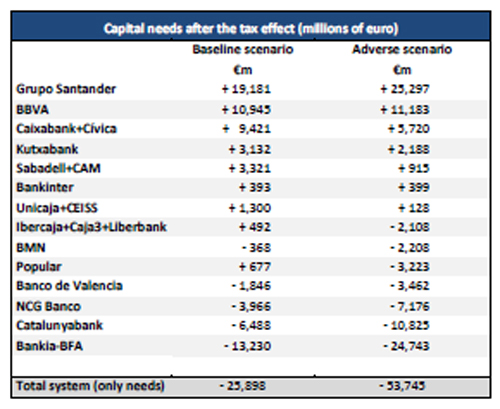

- Additional capital needs have been identified for the remaining groups, on top of those existing as at 31 December 2011, that amount to €59.3 billion when the integration processes under way and deferred tax assets are not taken into account. This amount falls to €53.75 billion when the mergers under way and the tax effects are considered.

The capital needs identified are the result of a very extensive and detailed analysis of the value of credit portfolios and foreclosed assets, and of the capacity of the banks to absorb losses over the next three years under a very adverse scenario. It is important to point out that the capital needs identified in the exercise do not represent the final figure of State aid to banks. This aid may be significantly less, as it will be determined once the measures envisaged in the recapitalisation plans to be submitted by banks to the Banco de España in October are taken into account.

Participating in the analysis were independent experts (consultants, auditors and real estate appraisers), along with the Banco de España and the Ministry of Economy andCompetitiveness. In the course of the exercise 36 million loans and 8 million guarantees were analysed by means of the appropriate sampling techniques, using in this connection the databases available both at the banks included in the process and at the Banco de España.

Six appraisal companies (3 national, 3 international) conducted 1.7 million automatic appraisals of houses and more than 8,000 appraisals of singular assets. The quality of the data used in this exercise was verified by more than 400 auditors from the four leading firms in the sector in Spain, analysing more than 115,000 operations. The process further benefited from the oversight of the European Commission, the European Central Bank, the European Banking Authority and the International Monetary Fund.

The estimated capital needs after the tax effect are detailed in the following table:

The exercise has established the capital that each bank or banking group would require to reach certain minimum reference levels set for a baseline macroeconomic scenario (considered likely) and for an extremely adverse scenario (considered very unlikely), defined over the period 2012-2014.

The analysis performed included a thorough review of the valuation and accounting treatment of the assets of Spanish banks, carried out by four audit firms and six appraisal companies, as envisaged in the Memorandum of Understanding (MoU) entered into by the Spanish and European authorities on 20 July this year, in the context of the programme of assistance for the recapitalisation and restructuring of the Spanish banking system.

The MoU specifies that the estimation of capital needs published today is an essential element of the plans laid down for the recapitalisation and restructuring of the Spanish banking system.

The steps that must be taken next are as follows:

- Formulation of recapitalisation plans for banks with a capital shortfall vis-à-vis the minimum level established in the stress test.

- Review of these plans by the authorities and classification of banks, following the MoU terminology, into Group 2 (banks that will require public support) and Group 3 (banks that will have until 30 June 2013 to implement their recapitalisation plan and to cover their capital needs). Group 2 banks must also submit a restructuring/resolution plan which will be evaluated by the Banco de España and sent to the European Commission for approval.

- Transfer of the troubled assets of the banks that require State aid to the Asset Management Company for Assets Arising from Bank Restructuring (AMC) envisaged for these purposes in the recent Royal Decree-Law 24/2012 of 31 August 2012.

- Raising of capital by banks that need it.

The estimated capital needs in the report by Oliver Wyman for various Spanish banks will not generally coincide with the amount of State aid required for their recapitalisation. The possible difference between the capital needs evaluated in the stress test and the State aid ultimately necessary will depend on the various actions that the banks incorporate into their recapitalisation plans, which may be summarised as follows:

- Disposal of assets.

- Raising of capital that may be obtained privately on the markets.

- Assumption of losses by the holders of hybrid and subordinated instruments, within the framework of Royal Decree-Law 24/2012.

- Transfer of assets to the AMC.

The exercise has focused on the 14 banking groups that were considered in the sector stress test (the top-down exercise), the results of which were released on 21 June 2012. This number takes into account the mergers that had been announced when the test was performed.

The results of the baseline scenario, with a capital ratio requirement of 9% for banks and a cumulative decline in real GDP of -1.7% over the period to 2014, are:

- 9 of the 14 banking groups would have sufficient capital under the baseline scenario (accounting for 75.6% in terms of the total assets of the sample). Consequently, in line with the analysis of the International Monetary Fund and the top-down stress tests, both of which were published in June 2012, it is confirmed that the banking system, in general, has high solvency levels that will enable it to withstand, without additional capital, likely developments in macroeconomic conditions.

- The aggregate capital needs under the baseline scenario would be slightly less than €25.9 bn. These are mainly at banks in which the FROB has a majority holding.

The results of the adverse scenario, with a capital ratio requirement of 6%, which envisages a cumulative decline in GDP of -6.5% over the period to 2014 and whose estimated probability of occurrence is less than 1%, are:

- The biggest capital shortfalls (around 86%) are at those banks which are majority-owned by the FROB: BFA-Bankia, Catalunya Banc, NCG Banco and Banco de Valencia. These four groups have already begun to work, together with the Spanish and European authorities, on their restructuring plans.

- Another three banking groups would need additional capital under the adverse scenario. These are: Banco Popular, BMN and the planned merger between Ibercaja, Liberbank and Caja 3. These banks will submit their recapitalisation plans in October 2012 for their approval by the Banco de España and by the European Commission. On the basis of these plans, the need for and amount of State aid shall, where necessary, be determined.

- Seven of the groups considered, accounting for 62% in terms of the analysed portion of the sector's credit portfolio, exceed the minimum capital requirements: Santander, BBVA, CaixaBank, Kutxabank, Banco Sabadell, Bankinter and Unicaja-CEISS. These banks will therefore not require additional capital even under a highly unfavourable macroeconomic scenario.